Many people—especially singles and young couples who are just starting their careers–have mixed feelings about purchasing a house. They worry about getting tied down and taking on a lot of debt.

Here are 10 compelling reasons why anybody who can afford it should consider buying a home:

1. House prices tend to rise over time, so a house is one of the best investments you can make. Home prices in the U.S. have risen three percent to six percent a year for the past 20 years. That trend is likely to continue. So if you buy a home now, you’ve put your capital in a safe investment where it is likely to grow.

2. You’ll pay less tax. You can deduct the interest you pay on your mortgage from your taxable income. The value of this tax break depends on factors like your personal tax bracket, the size of your mortgage, the rate of interest you pay on it and how long you’ve held the mortgage. As a rule, the newer the mortgage, the greater the amount of interest you pay each month and the bigger the tax break. Therefore, recent buyers with young mortgages tend to get the greatest benefit.

3. You’ll be buying a piece of real property rather than putting money in a landlord’s pocket each month. The real cost of renting is higher than the monthly payment. There is also an opportunity cost equal to the amount you would gain by using the money to purchase a home instead. Even if the house you purchased did not appreciate in price, you would be able to sell it and recoup some of the money you put into it.

4. Interest rates are currently very low. This makes it relatively inexpensive to take out a mortgage. The lower the interest rate, the less you actually pay for your house and the sooner you can pay the mortgage off. Use our calculator to see how different interest rates affect the total cost of your mortgage and the time it takes to retire it.

5. You’ll be able to use the equity in your home for low-cost loans for other purposes. You can access the paid-up equity you accumulate in your home in the form of a home equity loan or a home equity line of credit. Because they are secured, home equity loans and lines of credit generally carry a lower interest rate than other types of consumer loans, such as auto loans. The interest on them is generally tax-deductible, as well.

6. You’ll have the stability and emotional security of owning your own home. No more worrying about dictatorial or negligent landlords, rent increases or the possibility your building will be sold and redeveloped or turned into a condo. You’ll be able to live in your house as long as you like, fix your monthly payments for as long as 30 years and you’ll be in charge.

7. You’ll be able to redecorate and renovate any way you like, any time you like. Rules about the paint colors you can use will be a thing of the past. And you’ll be able to tear out walls, install a powder room and make any other improvements you want. Best of all, if you decide to sell, you’ll recoup at least part of the cost of the improvements.

8. You can have a garden. This is one of the big pluses of ownership–a little piece of land you can call your own, where you can grow tomatoes or roses, barbecue, and play with your kids and pets.

9. You’ll be able to put down roots in a community. When you’re a homeowner, you’ll get to know your neighbors, participate in street sales, meet potential baby-sitters and play Saturday-morning touch football in the park. Renters tend to live more insular lives.

10. You’ll have a greater voice in community affairs. Local homeowners generally have more clout–individually and through ratepayer’s associations–when it comes to development proposals, school issues, changes to traffic control and routing and the like. Because renters tend to be more transient than homeowners, they have less influence on policymakers.

Raise the Value of Your Home with These 7 Remodeling Tips

Raise the Value of Your Home with These 7 Remodeling Tips  Increase Your Curb Appeal

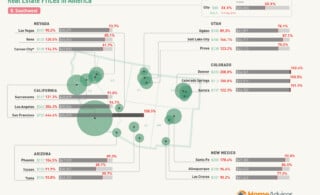

Increase Your Curb Appeal  Real Estate Affordability Across America – How Does Your City Stack Up?

Real Estate Affordability Across America – How Does Your City Stack Up?  5 Reasons Your House Isn’t Selling

5 Reasons Your House Isn’t Selling  Home Appraisals

Home Appraisals

Real estate properties, including houses, have prices that tend to rise over time as you mentioned to which I agree so I might try to buy a house while the prices are low enough for me to do so. I do like the idea that interest rates are currently very low as you have stated, and I’ll use this information to get the best rates to finally get my own home. If I get my home from a legitimate and reputable real estate company, then you should be right about what you said which is that I’ll be buying a piece of real property which I can give to my child when he finally grows up and I’m too old to keep it.