June 17, 2016

Baby boomers account for nearly half of all spending on home improvement projects nationwide and they when they undertake a project they invest “for keeps.” More than 60% of them plan to stay in their home as they age, so with that expectation in mind, they tend to pay a little more to get high-quality materials and to get the best workmanship. An analysis by Zelman and Associates shows that, even after the kids move out, most empty-nest parents want to remain in a single-family home.

The study, which examined data from the Census Bureau, shows that the percentage of households with children falls starting when the parents are in their mid-40s, dropping from 70% to just over 30% by the time the parents are in their late 50s, and the percentage of households in single-family homes continues to rise above 70% after age 45 and does not decline until age 75.

This refutes the axiom that empty-nesters always seek to downsize. As a matter of fact, many empty-nesters are deciding to reconfigure space within the same home, and have space available for the kids (and grandkids) when they come to visit. When these people put money into a home improvement project, they invest with a long time horizon in mind, and that can include putting in features that will help them as their knees get creakier and their eyesight less keen.

But let’s move the discussion beyond aluminum grab bars and widened doorways; we at HomeAdvisor have been talking about changes that can optimize their house to support aging in place (or as housing scholar Marianne Cusato calls it, “Thriving in Place”), that appeal to all ages. There are ways that a house can be made more enjoyable for people of any age. A good example: improvements that provide more light, particularly natural light, appeal to everyone, but are particularly helpful to people whose eyes are no longer as sharp in dim light.

But let’s move the discussion beyond aluminum grab bars and widened doorways; we at HomeAdvisor have been talking about changes that can optimize their house to support aging in place (or as housing scholar Marianne Cusato calls it, “Thriving in Place”), that appeal to all ages. There are ways that a house can be made more enjoyable for people of any age. A good example: improvements that provide more light, particularly natural light, appeal to everyone, but are particularly helpful to people whose eyes are no longer as sharp in dim light.

There are smart-home technologies that are not only helpful to people as they get older, but that also make things more convenient and more fun for younger buyers. Examples include the well-established and familiar upgrades like security systems, programmable thermostats, and garage door openers, but also newer types of upgrades such as voice-activation and smartphone controls for lights, appliances, thermostat, and other home systems.

But, some will say, 60-somethings don’t feel comfortable buying new tech. The ads and websites we see for home automation (Samsung SmartThings, Insteon, Wink, etc.) feature case studies of young people and offer a whole-home solution in a box. These systems are not being marked directly to older homeowners (and we believe that a huge opportunity exists for businesses to provide more of an in-person hand-holding approach for them).

A new survey of home service professionals undertaken by HomeAdvisor (“Aging in Place Report” October 2016, authored by Marianne Cusato) found that two-thirds (67 percent) of homeowners over age 55 believe smart-home technology could help them age in place, yet fewer than 1 in 5 (19 percent) have actually considered installing it for such purposes.

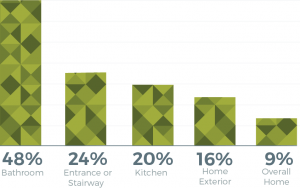

What Room Is the Most Popular for Aging-Related Renovations?

Fortunately, people in their thirties and forties with aging parents, some of whom are the early adopters of smart-home tech, are often buying the most cutting-edge systems for their parents which substantially accelerates adoption of the less familiar technologies by the retiree group. A 2016 study undertaken by Xfinity found that one in five consumers who bought smart-home technology did so with the motivation to assist in providing care for elderly parents.

This takes a back seat to other motivations (nearly 2/3 of respondents were motivated by the desire to “keep my family safe”), but it is nevertheless significant. Adult children of aging boomers are increasingly empowering and protecting their parents. A study undertaken last year by HomeAdvisor (“Aging in Place Report” October 2015) found that when a homeowner didn’t contact the pro themselves, the homeowner’s daughter made the call (daughters were five times more likely to have initiated contact than sons).

Admittedly, HomeAdvisor’s research shows that grab bars and ramps are still at the top of the list of modifications that this group needs, at 76% and 64% of aging-in-place requests, respectively, but it also highlights growing demand for modifications that have broad appeal and that do not have any “elderly” stigma, such as lever-handled doorknobs (30%), soft flooring (29%), pullout shelves (25%), and electrical outlets that are a little higher off the floor (10%).

So, given the proven utility of these kinds of alterations, when should somebody start thinking about home improvements directed toward “thriving-in-place”? There are several reasons for homeowners to start on such projects sooner rather than later.

- If they start early, they can spend sufficient time researching and planning so they avoid wasted time and suboptimal solutions.

- They are more likely to avoid a problem that often comes with waiting until they actually have a physical limitation: they may have to move to a different place because the lead-time might be longer (and the cost may be higher) by then.

- They can protect (and possibly even raise) the resale value of the home by taking a thoughtful, well-researched approach. They can make the home more appealing to buyers in all age groups with modifications that have broad appeal.

- In the future, when mortgage rates go higher, some people who still have a 2016-level fixed mortgage rate will think twice about selling their home to move to a different one. They will realize that they will face a higher monthly payment for the same size and quality of the home, and may instead decide to improve the home they have and keep their 3.5% mortgage rate. Also, some people may have difficulty getting another 30-year mortgage because of their age and that may also lead them back to modifying their current home to suit their needs.

There is no doubt that a surge in home improvement is coming, stimulated by the changing needs of the powerful baby boom generation. And the kinds of modifications and additions retirement-age desire “aren’t what they used to be.”

Three Hidden Benefits of Installing Smart Home Technology

Three Hidden Benefits of Installing Smart Home Technology  Top States for Home Improvement

Top States for Home Improvement  America’s Costliest Kitchen Projects

America’s Costliest Kitchen Projects  Preparing Your Business for the Aging-in-Place Boom

Preparing Your Business for the Aging-in-Place Boom  More Evidence on the “Nesting is Investing” Trend

More Evidence on the “Nesting is Investing” Trend

Are You Familiar With This Topic? Share Your Experience.