Rising housing, education, and healthcare costs make millennial homeownership seem out of reach for many. As of 2018, millennials have spent 39 percent more for a house than their baby boomer counterparts. It can take up to 10 years to save enough for just a 20 percent down-payment.

Luckily, buying a house doesn’t have to be this stressful. Here are seven ways for you to save up and become a homeowner in your twenties.

1. Think about what kind of house you can afford.

If you’re looking to have enough money saved up soon, be realistic about what kind of house you can afford in your timeframe. Mortgage lenders usually require a 20 percent down-payment at the time of purchase. However, if your state has a first-time homebuyer program, this number could be as low as 3 percent. Participating states offer different benefits, but some common ones include:

- Interest assistance from organizations to help borrowers pay off interest or qualify for lower-interest loans.

- Grants for mortgage down payments, closing costs and even future home-related projects.

- Loan forgiveness of all mortgage debt after a specified number of years, encouraging homeowners to stay in their home longer.

Tip: Veterans can apply for a VA loan to get zero percent down and lower interest rates.

From there, decide how much house you can get for your money. Depending on your needs and location, this could be a single- or multi-family house, a condo or, if you’re willing to do the work yourself, a fixer-upper. In any case, your mortgage payments should not exceed 28 percent of your gross monthly income.

2. Pay your bills regularly and on time.

Lenders love borrowers who demonstrate financial responsibility. They’re much more likely to lend and negotiate lower down-payments for people with strong credit. If you have outstanding credit card or student loan debt, pay that off first. Do it regularly and on time. Missed or late payments don’t help your credit score.

Tip: If student loan debt is a major obstacle, you could potentially enroll in an income-based repayment program (for federal loans) or defer your payments altogether. However, deferment could mean higher interest payments. On the other hand, you may find mortgage payments more beneficial to student loan repayment than higher rent costs, depending on location.

3. Open a savings account that offers better interest.

Skip the traditional savings account and bank your earnings in a high-yield savings account. Unlike a typical saving account’s 0.01% interest rates, a high-yield account can generate anywhere between 1.6 to 2.0% annual yield. Citi, American Express and Barclays are among several banks that offer these options.

Note: Find out if your bank requires a minimum balance and additional fees for this savings account.

Tip: Automate your savings plan. Don’t trust yourself to put away your own earnings. Have your employer direct a set portion of your income into your savings account to prevent any temptation to spend it.

4. Create (and stick to!) a budget.

Saving up for any major expense requires a budget. Be honest with yourself about how much money you currently spend and eliminate any unnecessary expenses, big or small:

- Cancel unused subscriptions. Trim Financial Manager instantly shows you all your current subscriptions and allows you to cancel any one of them from the app.

- Cut down on eating out during the week. You save a lot more by cooking meals at home.

- Skip the car commute if you live in a city with reliable public transportation.

- Prioritize investments. Decide whether buying a house takes immediate priority over a 401(k) plan or student loan repayment.

Tip: Track your expenses in a spreadsheet. Or, budget with Amazon Allowance, which puts spending limits on your account so you don’t accidentally overspend.

5. Bank every windfall.

Tax returns, raises, bonuses and birthday gifts make it easy to splurge, but mortgage lenders want prospective homebuyers to demonstrate good credit and saving abilities. Every windfall is a perfect opportunity to save money that won’t eat into your regular earnings.

6. Take advantage of tax deductions.

Here are a few of the many popular deductible opportunities you can capitalize on this year:

- Charitable Donations: Donations to participating organizations are tax deductible. In 2018, you can deduct donations worth up to 60% of your income. Just make sure you’re able to prove your activities to the IRS.

- Job Search Costs: Searching for new employment in your field can make you eligible for deductions related to the costs associated with the hunt.

- Medical Bills: Unreimbursed medical and dental expenses exceeding 7.5% of your Adjusted Gross Income are eligible for deduction.

- Tax Preparation: Deduct fees from 2017 that you accrued preparing for tax season in 2016.

Note: Various provisions from the Tax Cuts and Jobs Act of 2017 (TCJA) will discontinue some of these opportunities after 2018.

7. Start a Side Hustle

Saving money is a given in your homeownership goals, but finding ways to earn more money certainly doesn’t hurt. Put in overtime at your current job, work a second part-time job, do some freelance work or earn passive income by monetizing things you already have or do. Here are some simple, money-making apps or sites you can use now:

- Uber or Lyft: Become a driver.

- TaskRabbit: Do chores for other people.

- Wag!: Walk dogs for busy owners.

- Instacart or DoorDash: Deliver groceries or restaurant food to customers.

- Amazon Flex: Deliver packages for Amazon for competitive pay. Hours are flexible and you can work whenever you want.

- Amazon Associates: Promote products for a small commission.

- Google Opinion Rewards: Complete online surveys.

- Ibotta or Shopkick: Earn points and cash rewards by completing daily shopping challenges. Take a picture of your receipt and get cash-back rewards or gift cards to your favorite retailers.

- BookScouter: Sell your old books. Just scan your book’s barcode and compare at all booksellers’ buyback prices at the same time for the best deal.

- Foap: Sell your photo collection to Bank of America, Pepsi or Getty Images at 50 percent commission per photo.

- Slidejoy: Check promotions or the most recent headlines. In other words, earn money just for using your phone as you normally would!

- AppTrailers: Watch app trailers and earn points to redeem cash rewards.

- Turo or VRBO: Rent out your car (Turo), spare bedroom or entire house (VRBO).

Takeaways

Buying a home today is tough and the value of a dollar isn’t what it was in 1975. Even so, motives for saving and spending haven’t changed all that much. With access to more online resources and tools than ever, you can save for a house smarter and faster.

Raise the Value of Your Home with These 7 Remodeling Tips

Raise the Value of Your Home with These 7 Remodeling Tips  2015 True Cost Report & Homeowner Insights

2015 True Cost Report & Homeowner Insights  Homeowners Devote Big Budgets to Bathroom Remodels

Homeowners Devote Big Budgets to Bathroom Remodels  Dream Remodel, Real-Life Budget

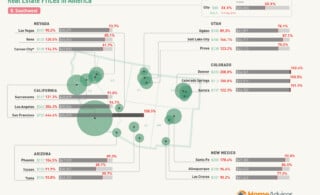

Dream Remodel, Real-Life Budget  Real Estate Affordability Across America – How Does Your City Stack Up?

Real Estate Affordability Across America – How Does Your City Stack Up?

Are You Familiar With This Topic? Share Your Experience.