You scraped together the down payment, endured the gauntlet of the house hunt, and signed enough documents at closing to cause a serious hand cramp. Welcome to homeownership! Now the real fun starts.

Owning a home is one of life’s great accomplishments and a source of endless pleasure and pride. But it’s also a huge responsibility, especially during the first year.

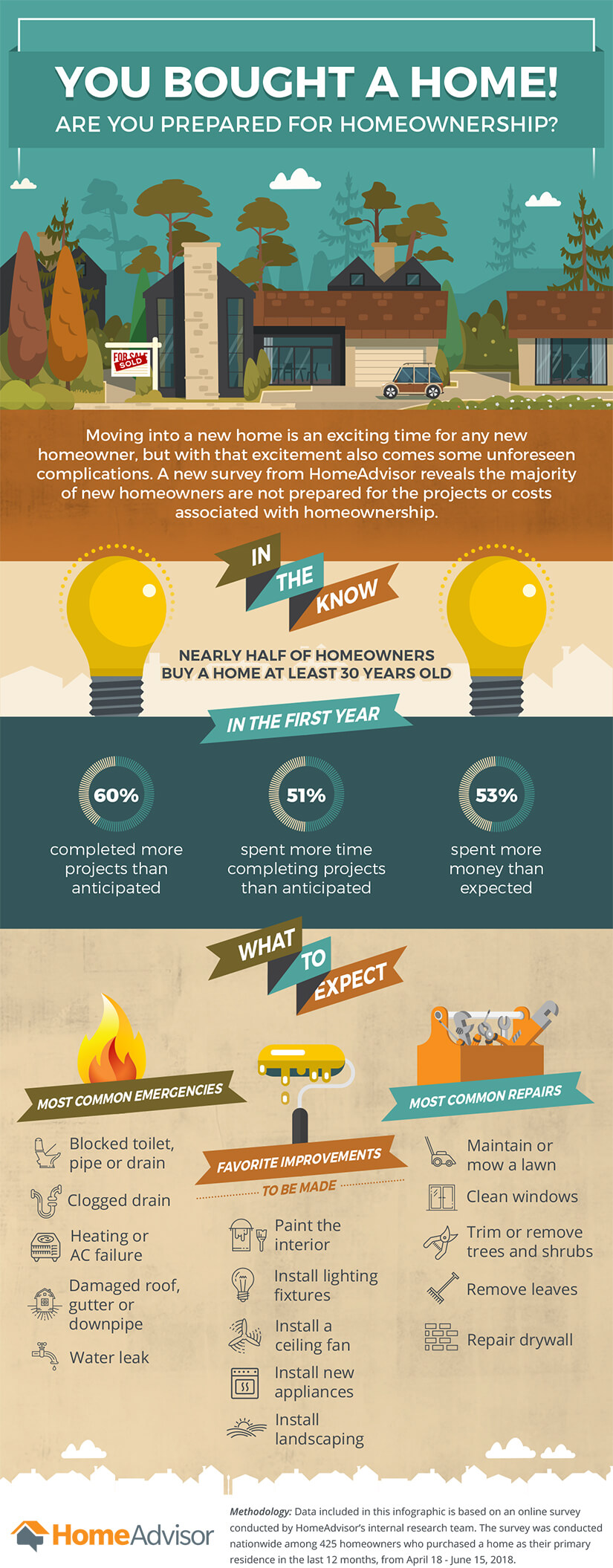

To help homeowners understand what they might expect in the first year of homeowners, HomeAdvisor surveyed more than 400 recent homebuyers to understand the biggest pitfalls encountered in that time.

We boiled the findings down to the following five rules. Stick to them closely, and your first 12 months will be budget-friendly and as stress-free as possible.

5 Things to Do After Buying a House

1. Follow the 5% Rule

Most homeowners underestimate how much time, effort, and expense goes into owning a home. In fact, 60 percent of homeowners surveyed said they completed more projects than anticipated in their first year; roughly half spent more than they expected.

That’s why it’s important to set aside money for sudden repairs. Ilyce Glink, author of 100 Questions Every First Time Home Buyer Should Ask, says homeowners “should expect to spend between 2 to 5 percent of the purchase price of the home per year in ongoing maintenance and upkeep.”

The best strategy is to build this rainy-day fund into your initial homebuying budget. If your home’s price was $300,000, plan to have between $6,000 and $15,000 in the bank after the closing. “If you can save up even more than 5 percent, anything you don’t use on your home can be salted away for bigger expenses,” says Glink.

2. Expect a Leak

I was in my new home for about six months when my wife started to detect a funny odor coming from the basement. Sure enough, the check valve on our sewer line was cracked. When the dust on the repair settled, we were out $6,000.

Three quarters of homeowners from our survey say they faced a costly, unexpected repair in their first year. Water looms large in the most common emergencies, including blocked pipes, clogged drains, damaged roofs and gutters, and other random leaks.

3. Improve its Value (Affordably)

Emergency repairs must be dealt with, meaning your year-one home improvement budget may be smaller than planned, after paying for costly repairs.

Focus on projects that will have the most bang for the buck. Homeowners from our survey prioritized projects that will significantly improve a home’s functionality.

- Painting projects cost most homeowners between $950-$2,800. This is a great option since it can dramatically change the look and feel of a home for relatively little cost.

- Putting in New Appliances averages between $115 and $275.

- Installing Lighting Fixtures costs $150-$810.

4. When Doable, DIY

Putting in a little sweat equity will cut your costs, plus it will help you get more familiar with your home.

Remember the three T’s: time, tools, and talent. Below are two examples of projects that make sense for a DIYer with all three.

- Painting checks every box, another reason it’s so popular.

- Lawn care is a perfect DIY project. It’s fairly easy, plus you can save between $800 and $1,200, depending on the length of the growing season.

5. Make a “Go-To Pros” List

When the dishwasher is overflowing or the central air conks out on the hottest day of the year, the last thing you want to have to do is call around looking for help. HomeAdvisor makes it easy to connect in seconds with trusted, prescreened professionals.

If you have long-term remodeling plans for the house, it’s worth forging a relationship with a contractor whose work you value. Most pros love a repeat customer, so they’ll happily take on smaller jobs (installing a ceiling fan, for example, or tiling the bathroom floor), if they know a gut kitchen renovation is coming down the line.

Fix-It 101: The Fix-It Literacy Guide

Fix-It 101: The Fix-It Literacy Guide  Engineering the Future: The Educator’s Guide to Building and Construction

Engineering the Future: The Educator’s Guide to Building and Construction  Preventing Home Improvement Fraud

Preventing Home Improvement Fraud  Working Well with Contractors: 15 Questions that Prevent Fraud and Ensure Satisfaction

Working Well with Contractors: 15 Questions that Prevent Fraud and Ensure Satisfaction  Report from PCBC: New Home Construction

Report from PCBC: New Home Construction

Are You Familiar With This Topic? Share Your Experience.