Congratulations! You’re a homeowner. You’ve searched far and wide for the perfect house and now you’re ready to make it your home. And while you’re probably pretty excited, there’s a good chance you might be feeling a bit overwhelmed by your newfound responsibility. Don’t worry: it’s perfectly normal. Of course, there are those who make owning a home more stressful than it should be. So, what do they do that you shouldn’t?

Mistake #1: Ignoring Routine Maintenance

Before you bought your home you made sure it passed its inspection with flying colors. At this point you know what needs your attention and what doesn’t. But just because your home is new to you doesn’t mean it won’t need a little TLC throughout the year. Whether it’s spending money on seasonal maintenance or addressing minor issues as soon as they pop up, staying on top of routine maintenance is the best way to ensure small problems don’t turn into major, not to mention costly, repairs.

Mistake #2: Making Major Changes Too Soon

You love your new house. You’d love it more if the kitchen was bigger or the floor plan was more open or those shrubs weren’t blocking the windows. But as tempting as it might be to make immediate changes, doing so could be a decision you end up regretting. Live in your house for a few months to get a better feeling of what you like and what you don’t. That way, when you make a major change you’ll know you’ve made the right decision.

Mistake #3: Overspending on Remodeling Projects

Owning a home isn’t cheap. In fact, nothing chews through your savings quite like a house. That’s not to say it isn’t worth it. With average appreciation rates between 3 to 6 percent, homeownership is still a good investment. The key is to not overspend. First, you don’t want to over-improve for your neighborhood. Doing so will price your home out of the market should you decide to sell. Second, and perhaps more importantly, you want to make sure you have the funds necessary to deal with any unexpected home repair emergencies.

Mistake #4: Getting in Over Your Head

Every homeowner has made the mistake of trying to take on a project they have neither the time nor ability to complete. Most of the time we do it because we don’t want to spend the money to hire a local pro and think we can save some cash by doing the job ourselves. Sometimes it works out. But what usually happens is that you wind up spending the same amount of cash on a project that takes ten times longer to complete than it should. Or worse, you spend the same amount of cash only to have to call a pro. Moral of the story: call a pro. (This is especially true if your project involves any system essential to the safe and convenient operation of your home.)

Ready to start your home improvements?

Find Pros

Mistake #5: Hiring the Cheapest Pro

So you need to hire a pro but don’t want to spend a lot of money. You get estimates from three pros and hire the one with the lowest bid. Smart move, right? Wrong. As with most things in life, you get what you pay for. Sure, the cheapest pro might do the best work, but there’s a better chance that they won’t. After all, there’s a reason they’re the cheapest. Hiring a pro is a major decision and price should only play a part in your choice. Instead of focusing on dollar signs, go with the pro you feel comfortable with and one you can trust to do the job right.

Want the dirt on additional projects topping new homeowners lists? Take a look at this infographic.

2015 True Cost Report & Homeowner Insights

2015 True Cost Report & Homeowner Insights  Homeowners Devote Big Budgets to Bathroom Remodels

Homeowners Devote Big Budgets to Bathroom Remodels  The Basics Of Lumber Pricing and Metal Pricing

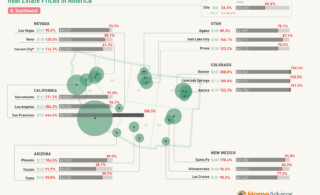

The Basics Of Lumber Pricing and Metal Pricing  Real Estate Affordability Across America – How Does Your City Stack Up?

Real Estate Affordability Across America – How Does Your City Stack Up?  HomeAdvisor: July Kicks Off Busy Season for Bathroom Projects

HomeAdvisor: July Kicks Off Busy Season for Bathroom Projects

Overspending on remodeling projects after buying a house is definitely a common mistake. That is why it is important to set the right budget and stick to it to avoid mistakes. Great article by the way. Thanks for sharing.