Rates Drop, What’s Next?

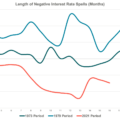

The quarter point drop is a welcome preventative measure. While the labor market and consumer spending remain strong, it increasingly looks as if the American consumer is propping up the global economy. An inverted yield curve, below-target inflation, continued trade uncertainty, and nervousness at the length of the expansion all have the potential to eventually make growth turn negative. It’s nice to see the Fed err on the side of caution.

For spending on home services, cheaper interest rates will likely serve as a nice boost to already healthy consumer demand, as financing projects becomes cheaper for homeowners and financing new equipment and capital becomes cheaper for home service professionals.

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics