HomeAdvisor True Cost Report 2016:

Home Improvement Thrives Amid Housing Market Recovery, Erratic Election Year

It’s an interesting year for home improvement. Improving U.S. labor and real estate markets – coupled with shrinking housing inventories and escalating home prices – are giving rise to an increase in homeowner spending on home maintenance, repair and improvement projects. And an election year, generational shifts and emerging regional influences are playing significantly into homeowners’ behaviors.

HomeAdvisor’s True Cost Report provides a glimpse into the improvements homeowners are making, how much they’re spending and earning on their investments, and how they’re researching and paying for projects. Additionally, to provide further perspective, the report offers a look at how generational, regional and political aspects affect American homeowners’ attitudes and decision-making when it comes to home improvement.

The True Cost Report is informed by HomeAdvisor’s True Cost Guide – a robust database that collects real cost data from millions of homeowner projects – as well as an annual survey designed to explore the ways in which homeowners budget, save and pay for home improvement projects. HomeAdvisor’s first True Cost Report was published in 2015, reporting on homeowner survey responses collected in February 2015 and forecasting through the next 12 months. The 2016 True Cost Report provides a comparative snapshot of homeowner survey responses collected in February 2016, further forecasting through the next 12 months.

Key Findings

Homeowners are completing more home projects – and spending more money – in 2016.

- Homeowners are completing more home maintenance, repair and improvement projects. In the past 12 months, the number of homeowners who reported completing two home maintenance and repair projects increased nearly 12 percent – and the number of homeowners intending to perform more home maintenance doubled. The number of homeowners planning a major home improvement project increased more than 5 percent.

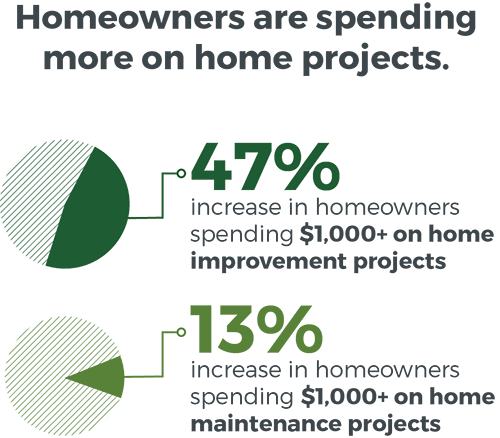

- Homeowners are spending more money on home projects. The number of homeowners spending more than $1,000 on home projects has increased over the last 12 months. Homeowners say they expect to spend a lot more on major home improvement projects in 2016 than they spent in 2015.

Homeowners are saving up and paying cash for big-ticket improvements and necessary repairs.

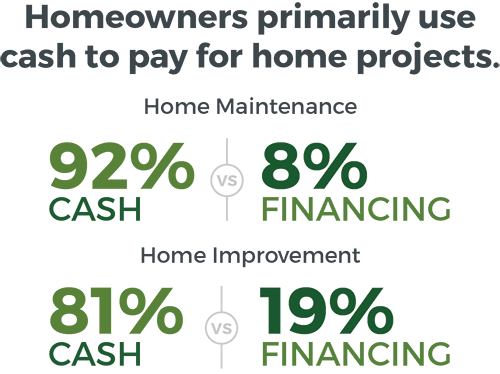

- Homeowners are primarily using cash to pay for projects. The majority of HomeAdvisor survey respondents reported using cash as their primary method of payment for home projects. The majority of those who did not pay with cash financed their home projects.

- Homeowners are purposefully saving for home projects. Home improvements rank second only to vacations when it comes to matters for which homeowners save money – ranking above cars, home appliances and furniture.

- Homeowners are most focused on remodeling, routine maintenance and repair, and energy and security projects. The top projects for which HomeAdvisor users have submitted service requests in the past year include alarm installation and locksmith services; energy audits; lawn maintenance, insect control and cleaning services; and interior and exterior remodels.

Political, generational and regional aspects play a key role in homeowners’ decision-making.

Political Aspects:

- Democrats are willing to spend more on home projects. In HomeAdvisor’s survey, Democrats reported a willingness to spend 1.5 times as much as Republicans on a home maintenance or repair project.

- Republicans are more likely to DIY expensive projects. Six in 10 Republicans – compared with just four in 10 Democrats – say they will do a project on their own when they think it will be too expensive to hire a professional.

Generational Aspects:

- Younger generations are more skeptical than older generations about project pricing. Millennials and homeowners in Generations X express greater concerns than Baby Boomers about knowing how much home projects will cost. They are also less confident they’re being charged a fair price for projects.

- Millennials, Baby Boomers and members of the Greatest Generation are completing the most home maintenance and repair projects. Of homeowners completing more than five maintenance and repair projects within the past year, 32 percent were Millennials and 34 percent were 55 and older. Interestingly, there are similarities in the home improvement spending habits of these generations as well.

- Baby Boomers and members of the Greatest Generation spend the most on home improvement projects. Of homeowners completing major home improvement projects within the past year, homeowners over 55 were most likely to spend more than $10,000. In fact, 47 percent of homeowners aged 55 and over reported spending $10,000 or more, compared with just 38 percent of homeowners under age 55.

Regional Aspects:

- Seattle homeowners are taking on the most home projects. According to HomeAdvisor’s True Cost Guide, homeowners in Seattle have completed more projects and spent more home project dollars than homeowners in Atlanta and Washington, D.C., in the past 12 months.

- Atlanta homeowners tend to finance home projects. Atlantans are more likely than homeowners in Seattle and Washington, D.C., to use financing to pay for home projects. In fact, one in six Atlanta homeowners reports using a credit card to finance a home project. This may be attributed to the fact that Atlanta’s economy has been among the slowest to recover, according to Realtor.com’s Chief Economist Jonathan Smoke.

- Washington, D.C., homeowners are DIY-shy. Only 42 percent of Washington, D.C., homeowners said that they would attempt a DIY home project.

Section 1: Home Projects Get a Boost in Recovering Housing Market

Times are ripe for home projects. A recovering labor market has provided more Americans more money to put into their homes, while a recovering real estate market has decreased housing inventories and increased home prices across the United States. The bad news is that the resulting situation is making it harder for many would-be buyers to find affordable new homes. The good news is that it’s providing homeowners equity that may be leveraged to further boost the enjoyment and monetary values of their existing properties. Consequently, homeowners who would otherwise upgrade to a more desirable home are choosing to stay put and make necessary repairs and improvements. And newer home buyers are buying and renovating older homes.

“Home improvement spending continues to benefit from the last years’ upswing in housing market conditions, including new construction, price gains and sales,” reports Chris Herbert, managing director of the Joint Center for Housing Studies of Harvard University. “Strengthening housing market conditions are encouraging owners to invest in more discretionary home improvements such as kitchen and bath remodeling and room additions, in addition to the necessary replacement of worn components, such as roofing and siding.”

Homeowners Are Doing More: Projects, Spending and Research on the Rise

The proof is in the numbers: According to HomeAdvisor’s 2016 True Cost Survey, homeowners are completing more home projects. In the past 12 months, the number of homeowners who reported completing two home maintenance and repair projects has increased nearly 12 percent – from 23 percent to 35 percent – and the number of homeowners intending to perform more home maintenance has doubled. Further, the number of homeowners planning a major home improvement project has increased more than 5 percent year over year.

The proof is in the numbers: According to HomeAdvisor’s 2016 True Cost Survey, homeowners are completing more home projects. In the past 12 months, the number of homeowners who reported completing two home maintenance and repair projects has increased nearly 12 percent – from 23 percent to 35 percent – and the number of homeowners intending to perform more home maintenance has doubled. Further, the number of homeowners planning a major home improvement project has increased more than 5 percent year over year.

Correspondingly, homeowners are also spending more money on home projects. In fact, in just the past year, the number of homeowners spending more than $1,000 on maintenance and repair projects has increased 13 percent (from 34 percent to 47 percent) and the number of homeowners spending more than $1,000 on major home improvements has increased 47 percent (from 32 percent to 79 percent). Homeowners also report that they expect to spend a lot more on major home improvement projects in 2016 than they spent in 2015.

Correspondingly, homeowners are also spending more money on home projects. In fact, in just the past year, the number of homeowners spending more than $1,000 on maintenance and repair projects has increased 13 percent (from 34 percent to 47 percent) and the number of homeowners spending more than $1,000 on major home improvements has increased 47 percent (from 32 percent to 79 percent). Homeowners also report that they expect to spend a lot more on major home improvement projects in 2016 than they spent in 2015.

Not only are homeowners spending more money on more home projects, but they are increasingly concerned about getting a fair price and avoiding project-related pricing scams as well. Half of homeowners surveyed expressed a concern about paying too much for their home projects, which likely accounts for the increase in the amount of homeowners using online tools like HomeAdvisor’s True Cost Guide to research home project costs. According to HomeAdvisor’s True Cost Survey, both the number of homeowners using online tools to research costs and the amount of homeowners spending between one and three months researching projects have increased. Nearly four in 10 homeowners report spending one to three months researching the costs associated with their home projects.

Cashing In: How Homeowners Budget and Pay for Home Projects

The majority of homeowners pay for home projects with cash, according to HomeAdvisor’s True Cost Survey. And those who can’t pay with cash are borrowing money to pay for their projects – taking loans from friends and family or using credit cards, home equity, peer-to-peer lending and other financing methods. In 2016, 92 percent of survey respondents reported paying for home maintenance and repair projects with cash, while 8 percent reported using financing (compared with 93 percent and 7 percent in 2015, respectively). Similarly, 81 percent of homeowners reported paying for home improvement projects with cash in 2016, while 19 percent reported using financing (compared with 83 percent and 17 percent in 2015, respectively). This suggests a slight year-over-year increase in the use of financing to pay for home improvement projects.

The majority of homeowners pay for home projects with cash, according to HomeAdvisor’s True Cost Survey. And those who can’t pay with cash are borrowing money to pay for their projects – taking loans from friends and family or using credit cards, home equity, peer-to-peer lending and other financing methods. In 2016, 92 percent of survey respondents reported paying for home maintenance and repair projects with cash, while 8 percent reported using financing (compared with 93 percent and 7 percent in 2015, respectively). Similarly, 81 percent of homeowners reported paying for home improvement projects with cash in 2016, while 19 percent reported using financing (compared with 83 percent and 17 percent in 2015, respectively). This suggests a slight year-over-year increase in the use of financing to pay for home improvement projects.

Interestingly, homeowners are more likely to save money for home projects than they are to save money for items such as cars and jewelry. In fact, home projects rank second only to vacations when it comes to homeowner savings – 66 percent and 58 percent of respondents reported saving for each expense, respectively.

Popular Projects: Average National Cost and Return on Investment

HomeAdvisor users submitted service requests for a variety of home projects in 2015, focusing most on remodeling, routine maintenance and repair, and energy and security projects. Interestingly, installing an alarm system and hiring a locksmith ranked highest among homeowner requests – suggesting that home security is a top homeowner concern. Remodeling projects – specifically kitchen, bathroom, garage and swimming pool remodels – were also popular, as was hiring an energy auditor, hiring an insect control service, and hiring for routine lawn care and cleaning services.

Here’s a Look at Some of HomeAdvisor’s Most Popular Projects and Their Average National Cost:

Popular 2015 Projects |

Average National Cost(As reported by HomeAdvisor users via True Cost Guide) |

|---|---|

| Install an alarm system | $670 |

| Hire a locksmith | $151 |

| Maintain a lawn | $164 |

| Hire an energy auditor | $372 |

| Remodel a kitchen | $19,993 |

| Remodel a bathroom | $9,285 |

| Remodel a garage | $10,664 |

| Remodel a swimming pool | $8,136 |

| Hire an insect control service | $183 |

| Hire a maid service | $181 |

Of the projects on HomeAdvisor’s list, homeowners may reap the highest returns on those related to remodeling, according to Remodeling Magazine’s 2016 Cost Vs. Value Report – though all of the year’s top projects will likely pay back on some level. “Bigger and more expensive projects, rising new home prices, curb appeal, and energy efficiency all contributed to a slight gain in remodeling projects’ payback at resale,” Remodeling’s 2016 Cost vs. Value report states. Further, the National Association of Realtors (NAR) says kitchen and bathroom remodels and new garage doors are among the five top projects on home buyers’ wish lists – yielding homeowners returns of 62 percent, 58 percent and 92 percent, respectively. Lawn care and other curb appeal improvement projects are also likely to garner significant returns; 12 of the highest-scoring home projects analyzed were exterior home projects.

Energy efficiency audits offer many opportunities for a significant return on investment. Not only will a home energy audit help determine where potential energy losses may be occurring, but it will also determine where improvements (i.e., money savings) may be made. Added attic insulation, for example, may recoup homeowners as much as 117 percent on their investment, according to the Remodeling 2016 Cost Vs. Value Report. And the U.S. Department of Energy claims that homeowners may save 5 percent to 30 percent on their annual energy bills just by making audit-recommended efficiency upgrades. Finally, a number of local governments and utilities provide rebates and other incentives for energy audits and energy-efficiency-related home improvements.

Section 2: In an Erratic Election Year, Political, Generational, and Regional Aspects Affect Decision-Making

Improved labor and housing markets have created a climate perfect for burgeoning home improvement, but a number of additional emerging factors play into homeowners’ decisions whether to seize the moment. As HomeAdvisor’s True Cost Guide and True Cost Survey data suggest, factors such as political affiliation, age and geographic location may significantly affect American homeowners’ attitudes and decision-making when it comes to home improvement and repair projects.

“The remodeling industry faces a radically different landscape than before the recession,” confirms the Joint Center for Housing Studies of Harvard University’s (JCHS) report on emerging trends in the real estate market. The generation of households now entering the housing market has different home improvement priorities.” Further, “as housing developers shift their focus from exurban communities toward suburban and older suburban neighborhoods, high-income metropolitan areas on both coasts are re-emerging as leaders in home improvement spending.”

Political Aspects:

As Wall Street Journal staffer Adam Bonislawski reports, elections can impact housing markets just as much as other, well-established influences can. In fact, as his source Princeton Economist Brandice Canes-Wrone asserts, it’s been found that there is “a link between the extent to which an individual believed the election would affect them personally and the likelihood of them delaying a house purchase until after the election.” With this in mind, HomeAdvisor set out to explore the impact of political affiliation and other aspects on homeowner attitudes and decision-making related to home improvement in the 2016 election year. HomeAdvisor’s findings suggest a remarkable correlation between homeowners’ political affiliations and their approach to home projects.

As Wall Street Journal staffer Adam Bonislawski reports, elections can impact housing markets just as much as other, well-established influences can. In fact, as his source Princeton Economist Brandice Canes-Wrone asserts, it’s been found that there is “a link between the extent to which an individual believed the election would affect them personally and the likelihood of them delaying a house purchase until after the election.” With this in mind, HomeAdvisor set out to explore the impact of political affiliation and other aspects on homeowner attitudes and decision-making related to home improvement in the 2016 election year. HomeAdvisor’s findings suggest a remarkable correlation between homeowners’ political affiliations and their approach to home projects.

Democrats do more research and are more willing to spend money on home projects, according to HomeAdvisor’s True Cost Survey. In fact, more than one-quarter of homeowners identifying as Democrats reported taking more than six months to research major home improvement projects, while 60 percent of homeowners identifying as Republicans reported spending fewer than three months. Further, of those surveyed, Democrats reported a willingness to spend as much as $3,417 on a home maintenance or repair project, while Republicans reported a willingness to spend only as much as $2,194. Conversely, Republicans are more likely than Democrats to complete projects on their own when they think hiring a professional will be too expensive, according to HomeAdvisor data, with 60 percent and 43 percent reporting such willingness, respectively.

Perhaps the most notable difference in the attitudes of Democrat and Republican homeowners is their outlook on the economy: Of those surveyed, 58 percent of Republicans and 27 percent of Democrats feel that the economy is poised to worsen a great deal.

Generational Aspects:

Two generational segments of the population may be primarily attributed with moving the real estate and home improvement markets forward, according to Realtor.com’s Chief Economist Jonathan Smoke – and there are a number of factors affecting their buying power. The first segment is older Millennials. They’ve benefited most from the economy; they’re the most educated generation; and, even though they’re dealing with student debt, they have good jobs for which they are well compensated, states Smoke. Further, since this group is likely buying their first homes, they’re more willing to take on home improvement projects to make them their own.

The second segment is emerging retirees (i.e., older Baby Boomers). This cohort is largely made up of wealthy homeowners, Smoke says. And, whether for the purpose of downsizing, locating closer to family, moving into a retirement community or otherwise, the time is right for them to sell. Because they’ve owned their homes through the ups and downs of the real estate market, this segment is able to tap into equity to pursue home improvement projects before putting their homes on the market, says Smoke. And like their Millennial counterparts, once they do move, they’re likely to embark on home improvement projects to make their new houses feel like home.

HomeAdvisor’s findings support Smoke’s assertion: Millennials and homeowners over 55 are most likely to spend money on home projects. Interestingly, in HomeAdvisor’s True Cost Survey, both Millennials and Baby Boomers report spending an average of around $6,000 on major projects in the past year – suggesting no significant difference in generational spending habits on major home improvements. The data does, however, suggest significant generational differences in attitudes about project research and payment. According to the True Cost Survey, Millennials are far less likely than Baby Boomers to feel that they’re getting a fair price for their projects. Further, homeowners over 45 spend more time than younger homeowners researching their home projects. When it comes to paying for projects, older homeowners are paying more for home improvement projects – and paying cash – while younger homeowners are turning to financing to pay for home improvement, maintenance and repairs.

Regional Aspects:

As JCHS reports: “Remodeling activity is highly concentrated within the nation’s metropolitan areas, with homeowners in those markets accounting for four out of five dollars of spending. Even so, wide differences in household incomes and house prices mean that average improvement expenditures, especially on larger discretionary projects, vary sharply across metro areas.”

To further explore the effect of such regional aspects on home improvement attitudes and decision-making over the past year, HomeAdvisor examined home project trends in Seattle, Atlanta and Washington, D.C. – three similar U.S. metropolitan markets with significant populations, healthy economies and proven housing crisis recoveries. A deeper discussion of HomeAdvisor’s geographic findings is included below.

Seattle homeowners are committed to home improvement. In the past 12 months, according to HomeAdvisor’s findings, Seattle homeowners completed the most projects within the three study areas. Further, they spent an average of $12,677 on home projects, which is significantly more than the national average spent on home projects ($6,614) and the highest within the three areas explored. Interestingly, Seattle homeowners have also saved the most money to pay for home projects ($8,042), while half report a willingness to finance projects when savings aren’t available. Further, more than half are willing to roll up their sleeves and give DIY a try when they find that projects are too expensive, and more than one-third will put off a project completely when they don’t know how much a project will cost.

According to Realtor.com’s Chief Economist Jonathan Smoke, Seattle’s commitment to home improvement may be largely attributed to consumer confidence. “Conditions that are related to strong consumer confidence include a strong job market, improving incomes, home values having recovered and people seeing positive equity in their home. That will all make them have relatively more confidence than in the average U.S. market.”

Atlanta homeowners favor home project financing. Atlanta homeowners have pursued, on average, fewer than four home projects within the last 12 months – spending less money than homeowners in Seattle and Washington, D.C., but still spending more than the average national homeowner. According to Smoke, the reason Atlantans aren’t pursuing as many projects as homeowners in other cities may be tied to a slower economic recovery. “Atlanta is currently the last of these markets to turn around,” says Smoke. “They didn’t start to see economic growth and start the recovery process until 18 months ago.” This would also explain why 60 percent of Atlantans report a willingness to use financing to pay for their home projects – and why 45 percent said they’d put off projects when they were unsure how much projects might cost.

Homeowners in Washington, D.C., are most likely to hire professionals. Homeowners in Washington, D.C., are the least likely within the three metro areas to consider DIY projects and the most likely to hire help (only four in 10 would try to complete a project on their own to save money). They are also the least likely to use financing as a method to pay for home projects (only 42 percent reported a willingness to pay with credit, compared with a national average of 43 percent). What’s more, Washington, D.C., homeowners also pursue the fewest number of home maintenance and repair projects within the three cities – despite the fact that, as Smoke notes, a number of factors make it the perfect market for home improvements. “Homes are expensive, equity in homes is significant, and there are some pretty old homes,” says Smoke. But, it’s also a transient market, he notes, where a number of residents live only for a short time. It’s the people who buy homes for the long haul, Smoke says, who are the most likely to be focusing on home improvement in Washington, D.C.

6 Steps to Hiring the Right Pro at the Right Price

Thinking of embarking on a home project? Follow these simple tips to hire the right home pro at the right price!

- Check references. Ask potential contractors to provide references for two to three past projects.

- Check licensing. Make sure contractors are appropriately licensed and bonded to work in your state.

- Research project costs. Use online cost tools like HomeAdvisor’s True Cost Guide to research how much other homeowners in your area paid for similar projects. Review and break down projected costs with each contractor you’re considering to ensure that you understand how the final costs may vary.

- Sign a contract. Be sure to sign a contract with a professional prior to starting a project. Always include the estimated project cost and timeline.

- Pay wisely. If your pro asks for your entire payment up front, start looking for a new contractor. Never pay more than 50 percent up front and never pay in cash.

- Schedule a walkthrough. Set up a time to walk through the finished product with your contractor to make sure you’re satisfied with the final product.

Top Cities

Top 10 Cities to Remodel a Garage

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Los Angeles, CA | $15,880 |

| San Jose, CA | Miami, FL | $15,000 |

| San Antonio, TX | San Francisco, CA | $14,883 |

| Dallas, TX | Atlanta, GA | $14,808 |

| Los Angeles, CA | Sacramento, CA | $14,703 |

| Portland, OR | Phoenix, AZ | $13,714 |

| Miami, FL | Albany, NY | $13,667 |

| Denver, CO | Boston, MA | $13,500 |

| Jacksonville, FL | Washington, DC | $12,069 |

| Minneapolis, MN | Houston, TX | $11,257 |

Top 10 Cities to Maintain a Lawn

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Atlantic City, NJ | $618 |

| San Antonio, TX | Richmond, KY | $553 |

| Jacksonville, FL | Redding, CA | $467 |

| Denver, CO | Mount Vernon, WA | $464 |

| Chicago, IL | Bridgeport, CT | $326 |

| Aurora, CO | Seattle, WA | $325 |

| Orlando, FL | Salinas, CA | $325 |

| Dallas, TX | Boston, MA | $320 |

| Charlotte, NC | Santa Rosa, CA | $318 |

| Columbus, OH | Ocean City, NJ | $304 |

Top 10 Cities to Install Alarm System

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | San Jose, CA | $1,181 |

| Las Vegas, NV | Boston, MA | $1,106 |

| Miami, FL | Baltimore MD | $1,092 |

| Philadelphia, PA | Riverside, CA | $1,073 |

| Orlando, FL | Lexington, KY | $1,067 |

| Atlanta, GA | New York, NY | $1,000 |

| Chicago, IL | Minneapolis, MN | $971 |

| Jacksonville, FL | Lakeland, FL | $964 |

| Dallas, TX | Charlotte, NC | $820 |

| Los Angeles, CA | Los Angeles, CA | $800 |

Top 10 Cities to Remodel a Bathroom

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Salinas, CA | $29,333 |

| Chicago, IL | Sarasota, FL | $19,096 |

| Miami, FL | Honolulu, HI | $17,875 |

| San Antonio, TX | Los Angeles, CA | $16,066 |

| Philadelphia, PA | Baton Rouge, LA | $15,167 |

| Fort Lauderdale, FL | Huntsville, AL | $15,000 |

| Denver, CO | Ventura, CA | $14,853 |

| Jacksonville, FL | San Francisco, CA | $14,747 |

| Columbus, OH | San Diego, CA | $14,301 |

| Brooklyn, NY | Birmingham, AL | $14,119 |

Top 10 Cities to Hire an Insect Control Service

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Bakersfield, CA | $539 |

| Philadelphia, PA | Ventura, CA | $488 |

| San Antonio, TX | Kingston, NY | $447 |

| Chicago, IL | Beaumont, TX | $412 |

| Los Angeles, CA | Binghamton, NY | $391 |

| Dallas, TX | Lexington Park, MD | $374 |

| Brooklyn, NY | Salinas, CA | $350 |

| Denver, CO | Morristown, TN | $340 |

| Miami, FL | Lexington, KY | $336 |

| Jacksonville, FL | Hilton Head Island, SC | $331 |

Top 10 Cities to Hire an Energy Auditor

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| San Antonio, TX | Los Angeles, CA | $1,801 |

| Las Vegas, NV | New York, NY | $622 |

| Dallas, TX | Philadelphia, PA | $568 |

| Denver, CO | Boston, MA | $555 |

| Brooklyn, NY | Houston, TX | $407 |

| Austin, TX | Dallas, TX | $395 |

| Fort Worth, TX | Ann Arbor, MI | $367 |

| Chicago, IL | San Francisco, CA | $367 |

| Henderson, NV | Washington, DC | $339 |

| Arlington, VA | Baltimore, MD | $325 |

Top 10 Cities to Remodel a Kitchen

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | San Francisco, CA | $34,364 |

| Chicago, IL | San Jose, CA | $31,639 |

| Philadelphia, PA | San Diego, CA | $30,417 |

| Miami, FL | Los Angeles, CA | $29,785 |

| San Antonio, TX | New Haven, CT | $29,392 |

| Denver, CO | York, PA | $28,408 |

| Brooklyn, NY | Ventura, CA | $28,068 |

| Fort Lauderdale, FL | Seattle, WA | $27,530 |

| Las Vegas, NV | Olympia, WA | $27,200 |

| San Jose, CA | Sarasota, FL | $27,045 |

Top 10 Cities to Hire a Locksmith

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Manchester, NH | $255 |

| Chicago, IL | Norwich, CT | $233 |

| Denver, CO | Trenton, NJ | $229 |

| Philadelphia, PA | Tucson, AZ | $211 |

| Washington, DC | Bridgeport, CT | $202 |

| Las Vegas, NV | Providence, RI | $201 |

| San Antonio, TX | New York, NY | $198 |

| Brooklyn, NY | Reading, PA | $196 |

| Los Angeles, CA | Boston MA | $195 |

| Dallas, TX | Hartford, CT | $193 |

Top 10 Cities to Hire a Maid Service

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | Rapid City, SD | $581 |

| Miami, FL | Lahaina, HI | $383 |

| San Antonio, TX | Bozeman, MT | $380 |

| Chicago, IL | Statesboro, GA | $292 |

| Fort Lauderdale, FL | Fresno, CA | $289 |

| Philadelphia, PA | Shelton, WA | $271 |

| Los Angeles, CA | Monroe, LA | $267 |

| Brooklyn, NY | Adrian, MI | $266 |

| Las Vegas, NV | Scranton, PA | $261 |

| Jacksonville, FL | Honolulu, HI | $244 |

Top 10 Cities to Remodel a Swimming Pool

| Most Volume | Most Expensive | Average Price |

|---|---|---|

| Houston, TX | New York, NY | $16,000 |

| Phoenix, AZ | San Jose, CA | $14,750 |

| Fort Lauderdale, FL | Philadelphia, PA | $14,217 |

| Las Vegas, NV | Los Angeles, CA | $13,237 |

| Miami, FL | Baltimore, MD | $12,333 |

| Tampa, FL | Washington, DC | $11,825 |

| Orlando, FL | Seattle, WA | $11,767 |

| San Antonio, TX | San Diego, CA | $11,630 |

| Pompano Beach, FL | Hartford, CT | $10,667 |

| Dallas, TX | Riverside, CA | $10,182 |

*Data included in the True Cost Report is based on a survey conducted by Hanover Research on behalf of HomeAdvisor. The survey was conducted among 1,653 homeowners, age 25 or older, from February 4-19, 2016. All survey participants were involved in purchasing decisions related to home maintenance and improvement projects completed in the last 12 months. Additionally, the data for the top home improvement projects is based on the number of service requests submitted through HomeAdvisor.com from March 1, 2015-March 1, 2016; project cost data is based on data submitted to True Cost Guide from April 4, 2008-March 1, 2016.